Surety is Not Insurance

A Performance Guarantee

So, what is it? A surety gives you the financial security you need to get down to business. When a surety bond is produced, it acts as a performance guarantee against future work. A surety bond is only extended if the surety determines that the party in question has the experience, financial and capital resources necessary to fulfill their obligations. If the insured party is unable to fulfill their end of the deal, the surety can then step in and provide support. Uses and application of surety bonds are unlimited.

The most common types of a surety product are commercial, contract and subdivision. The Trisura team brings real-life experience to the table; no matter your circumstances, we can help you achieve optimal results.

Commercial Surety

Commercial surety products are usually part of licensing processes and requirements for companies or individuals. These bonds protect the consumer against fraud, misrepresentation and compensation of monetary loss.

Commercial surety bonds are typically required by federal and/or state courts, government bodies, financial institutions and private corporations.

At Trisura, we understand that guidelines and regulations can get complicated. We treat our clients like partners and work together every step of the way, to remove the “red tape.”

Contract Surety

Types

Bids and Tenders

Performance Bonds

Labour and Material Payment Bonds

Contract surety bonds guarantee that the contractual obligations of a project are fulfilled by the contractor.

Trisura primarily offers contract surety solutions to construction companies, service contractors, suppliers and manufacturers.

Subdivision Surety

Subdivision bonds, also referred to as site improvement bonds, are generally required of builders or developers to guarantee completion of infrastructure work such as electrical lines, sewers, sidewalks or grading, and other types of work associated with a permit issued by a local, country or state authority.

Unlike other sureties, Trisura does not categorize subdivision as either contract or commercial. We treat it as a separate line of business that necessitates a unique approach to underwriting. At Trisura, we evaluate all aspects of a project, including capital structure and financing, experience and finally, indemnity structure.

We will consider site improvement bonds for national home builders (both public and privately held), regional builders and developers, and large, multi-phased projects that are institutionally funded (pension funds).

First Founders Assurance Company

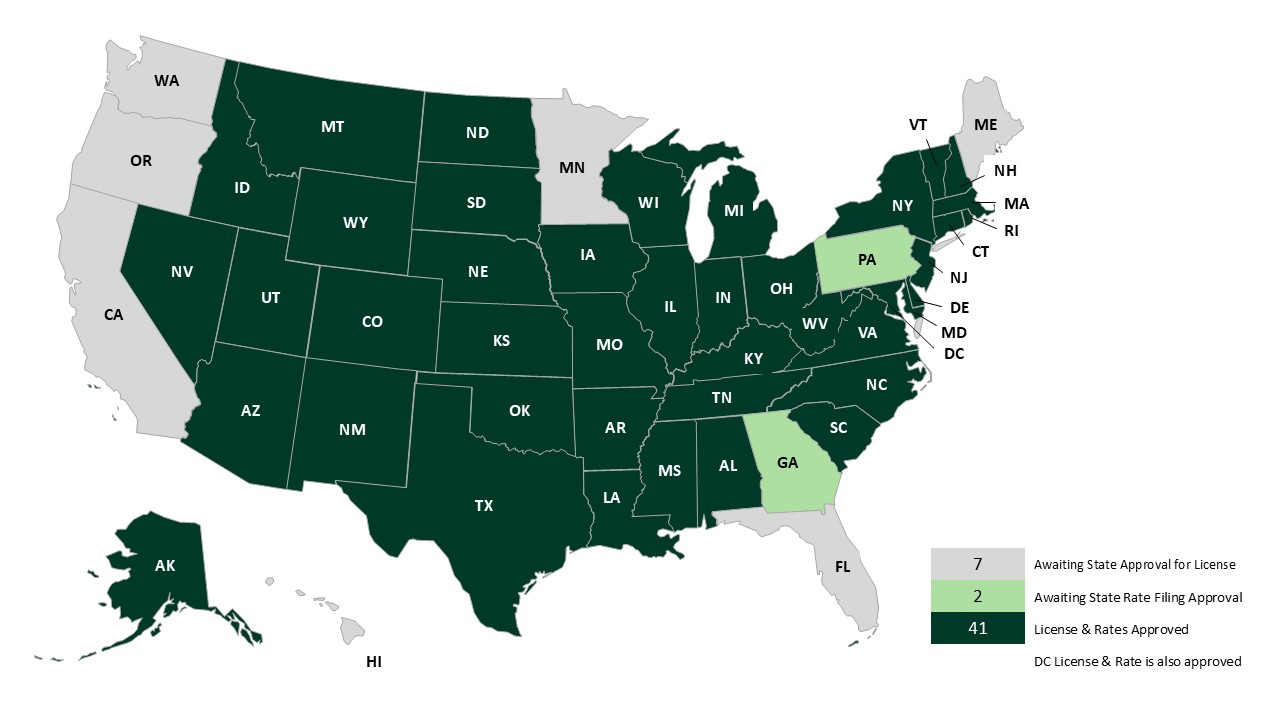

In March 2024, Trisura acquired First Founders Assurance Company ("FFAC"), a U.S. Treasury listed surety company, further demonstrating Trisura's commitment to the U.S. surety market.

Since then, we have been working to have FFAC licensed (with approved rates) in all 50 states. FFAC has currently been approved in the following states: Alabama (AL), Alaska (AK), Arkansas (AR), Arizona (AZ), Colorado (CO), Connecticut (CT), Delaware (DE), Idaho (ID), Indiana (IN), Iowa (IA), Kansas (KS), Kentucky (KY), Louisiana (LA), Maryland (MD), Massachusetts (MA), Mississippi (MS), Missouri (MO), Montana (MT), Nebraska (NE), Nevada (NV), Michigan (MI), New Hampshire (NH), New Jersey (NJ), New Mexico (NM), New York (NY), North Carolina (NC), North Dakota (ND), Ohio (OH), Oklahoma (OK), Rhode Island (RI), South Carolina (SC), South Dakota (SD), Tennessee (TN), Texas (TX), Utah (UT), Vermont (VT), Virginia (VA), West Virginia (WV), Wisconsin (WI).

*Awaiting state rate filing approval

Why Trisura?

We are motivated

We evaluate the right solutions for your business needs, and we look for ways to say yes instead of no.

Why Trisura?

We are experts

With in-depth industry knowledge and real-life experience, our team of seasoned underwriters can anticipate every scenario, helping you achieve the best result for your business.

Why Trisura?

We are partners

At Trisura, we take the time to get to know you and your clients. This means getting together and listening to everyone’s stories. We look forward to growing with you as part of an enduring, successful relationship.

Why Trisura?

We are Trisura

We underwrite with attention, skill and urgency. We aspire to be your partner of choice.